Apple Health Dental changes can be scary if you don’t know.

Yes there has been a big change to Apple Health in regards to Dental Care. Yes, we write a lot of dental Insurance at Wenatchee Insurance. As part of the budget the Adult and children’s Apple Health (Medicaid) dental rates are being reduced effective July 1st, 2025.

In our area we have a select few dentists and orthodontists that accept Apple Health. When our son needed braces, every six weeks we would make the drive from Wenatchee to Ellensburg so that he would have his teeth worked on. It took a lot of coordination between his pediatric dentist and the orthodontist to get the approval.

Where to find Apple Health Dental care?

OK, have you been to the Dentist Link Set up by the Healthcare Authority? It provides an excellent search tool to find a dentist accepting Apple Health Dental in your area. You can also call or test a referral specialist 844-888-5465 from 8 am to 4:30 pm on weekdays.

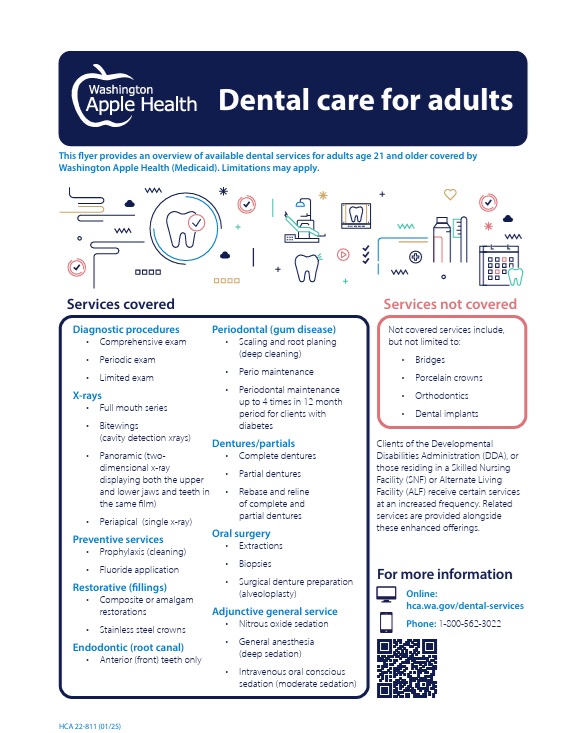

What does Apple Health Dental cover for adults?

If you have Apple Health as an adult it covers more than people think. Yes, it really does take care of fillings, front teeth root canals and dentures. There are some things that it doesn’t cover by it’s self like Dental Implants and Adult Orthodontics.

How do I enroll?

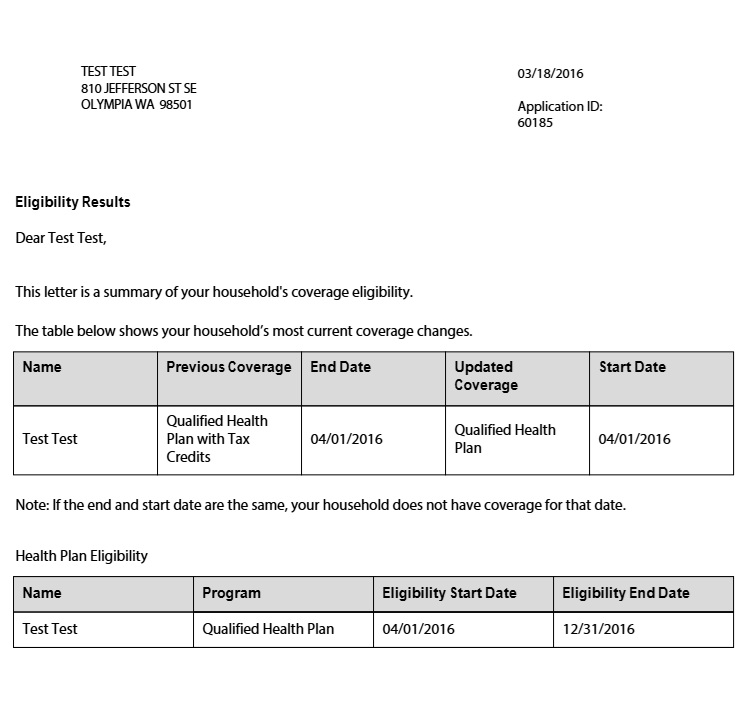

Suzie and Matt have been assisting people enroll for over a decade into Apple Health plans. We have never charged a fee and do not get paid for enrolling people in these plans. We do it because people in our community use healthcare and it is expensive to go without. There are no enrollment periods with Apple Health and it is based on our income level.

Children have expanded access to Apple Health using the Children’s Health Insurance Program (CHIP). Some will be zero cost or there will be a $20 or $30 monthly charge per child fee. We have a lot of families where the parents are on a paid health plan and the kids are on Apple Health. The important thing is that the family is being covered.

What happens if I am no longer eligible for Apple Health Dental

We have the conversation. We have access to several dental plans that a person can enroll year round. Some with waiting periods and some without. We even have plan that can assist adults with getting braces after a waiting period at Wenatchee Insurance. We make it as easy as possible to review your options.

Enrollment Periods

There are times when it get’s incredibly busy for healthcare so you may have to wait a little bit longer in the Fall.

For Medicare the Annual Enrollment Period for Medicare Drug Plans and Medicare Advantage plans is October 15th through December 7th.

For Medicare’s Initial Enrollment it is three months before you turn 65, the month of your birthday and three months after.

For Healthcare the Open Enrollment Period is November 1st through December 15th. (some states may have an extension so do not hesitate to ask).

Yes, people set appointments early in the year for fall appointments to insure that they are able to have a conversation about the changes to their health plan.