Don’t Miss the Boat: Health Insurance & Medicare Enrollment Dates in Washington

Let’s talk about the least exciting calendar dates you’ll ever mark with a glitter pen—health insurance and Medicare enrollment deadlines. But just because they don’t come with cake or party hats doesn’t mean they’re not important. Miss the window, and you might end up paying more than your fair share (or going without coverage—yikes!). Luckily, Suzie from Wenatchee Insurance has your back, clipboard in hand, ready to keep you on track across North Central Washington.

Health Insurance Enrollment (AKA: Don’t Snooze, or You’ll Lose)

If you’re under 65 and buying your health insurance through the Washington Healthplanfinder, here’s what you need to know:

- Open Enrollment:

November 1 – December 15

This is the biggie. You can sign up, switch plans, or renew your current coverage. Want to ring in the New Year without a health insurance hangover? Select an appointment early as this is the shortest enrollment ever in Washington State! - Special Enrollment Periods (SEP):

Life happens—marriages, babies, losing job-based insurance, moving, or even getting out of jail (yes, that’s a legit trigger). These events may qualify you for a 60-day SEP.

Suzie’s advice: “If you’re not sure whether your life change qualifies, give me a call. I love solving insurance mysteries more than I love huckleberry pie. And I really love huckleberry pie.”

Medicare Enrollment (It’s Like Health Insurance, But With More Acronyms)

If you or a loved one is turning 65, you’ve got your own enrollment clock ticking. Medicare has its own little maze of dates, but Suzie knows the shortcuts.

- Initial Enrollment Period (IEP):

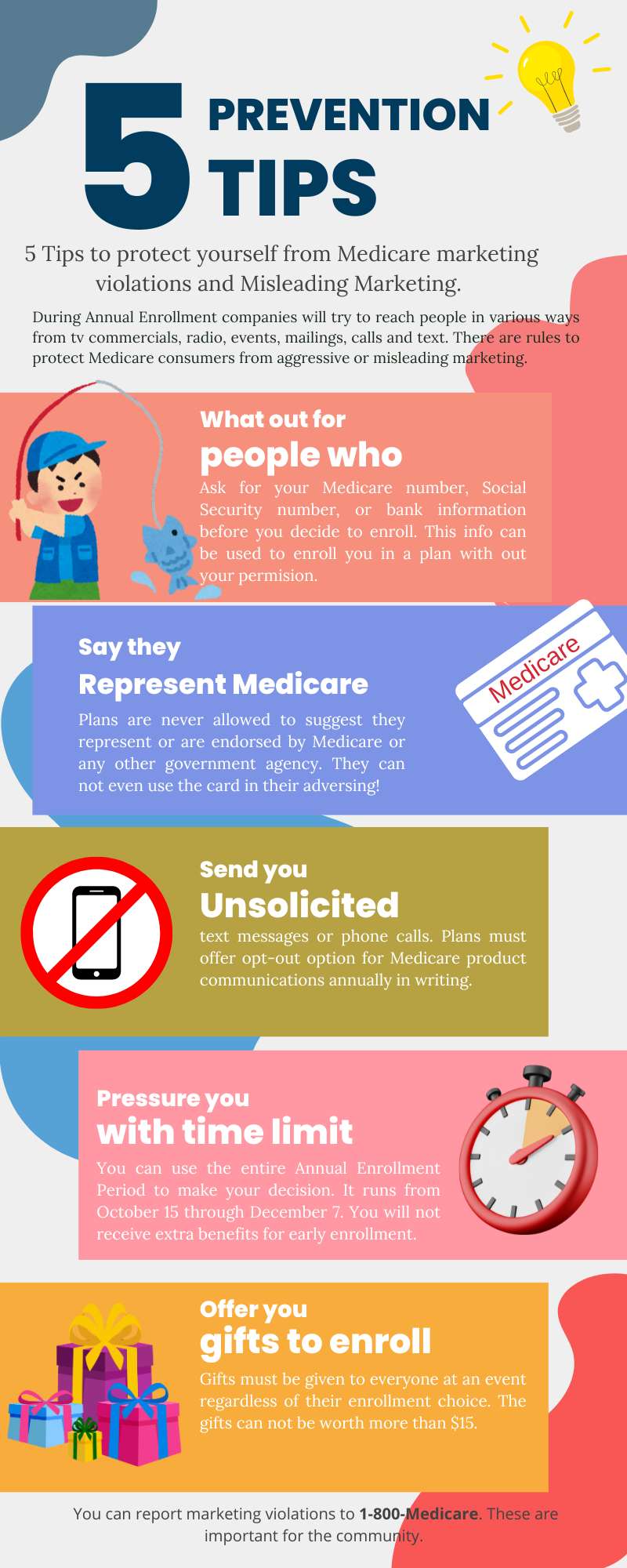

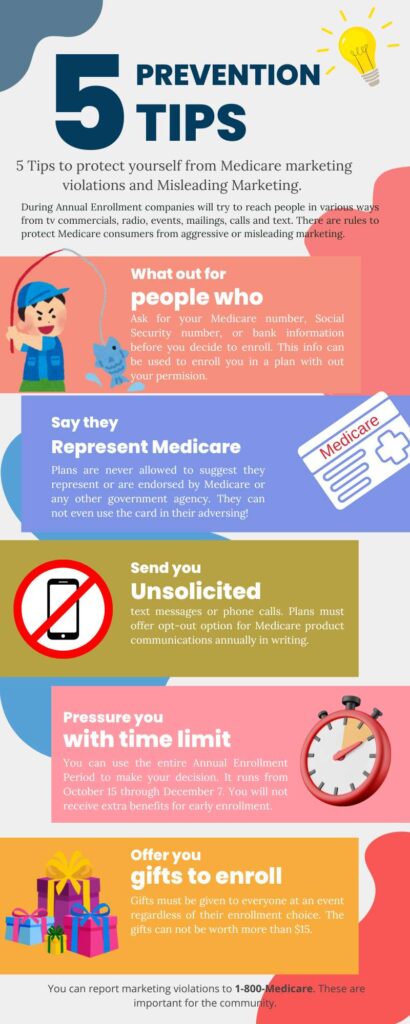

Starts 3 months before you turn 65, includes your birthday month, and goes 3 months after. That’s a 7-month window to get into Medicare Part A and Part B. - Medicare Advantage & Drug Plans (Part C & D) Annual Enrollment:

October 15 – December 7

This is the time to change, drop, or add Medicare Advantage or Prescription Drug Plans. Your changes kick in January 1. - Medicare Advantage Open Enrollment Period:

January 1 – March 31

Didn’t love your Medicare Advantage plan after New Year’s? You get one switch during this time.

Suzie’s tip: “Don’t wait until December 6 to call me. I’ll be caffeinated, but it’s best to chat while we’re both relaxed and not trying to understand Medicare with Christmas music blasting in the background.”

Native American Health and Apple Health

These applications have year round enrollments. Apple Health is Washington State’s Medicaid program that we have a special information site set up for. If you have a Tribal Affiliation then yes, you can enroll every month of the year. It is why we run applications year round.

Why Suzie from Wenatchee Insurance Should Be Your First Call

Navigating enrollment periods in Washington state is like trying to find a parking spot at Pybus Market on a Saturday morning—possible, but easier with a little help. Suzie doesn’t just know the dates, she knows the plans, the fine print, and where to find extra savings or better networks across North Central Washington.

Call Suzie at Wenatchee Insurance before your deadline becomes a dead-end. She’ll make sure you’re covered, confident, and maybe even chuckling through the paperwork.

📞 509-295-9055

🌐 wenatcheeinsurance.com

Let Suzie put the fun back in functional insurance enrollment deadlines!