If you pay for your health insurance on the Washington Healthplanfinder then you must file your taxes every year. It is an IRS rule. Yes, regardless of your income level, you will always want to file your taxes. If your Uncle Fred says that you do not need to then look at what Uncle Sam has to say about the IRS rule.

During the first couple of weeks of the year a copy of a Form 1095-A is mailed out. If you can not find a your copy then let us know. Since the second year, we have been printing and email copies to our customers at no charge so that they could file their taxes.

(If you have Apple Health then you could receive a Form 1095-B. This form is not required to file your taxes and you can request a new copy from the Healthcare Authority. )

When you file your taxes, you take the information from your 1095-A and reconcile it using the IRS Form 8962. It involves comparing the amount of premium tax credits used with the eligible amount, based on final annual income. This is why you want your income on the Washington Healthplanfinder as accurate as possible and you can updated it during the year if your income changes.

The Advanced Premium Tax Credits are what is used to lower your monthly cost of health insurance. It is an advance so if you underestimate your income then you will be asked to pay back the portion that was advanced to you. The reverse is true if you over-estimate your income while you will pay more monthly for health insurance then you will also be paid back any unused tax credits.

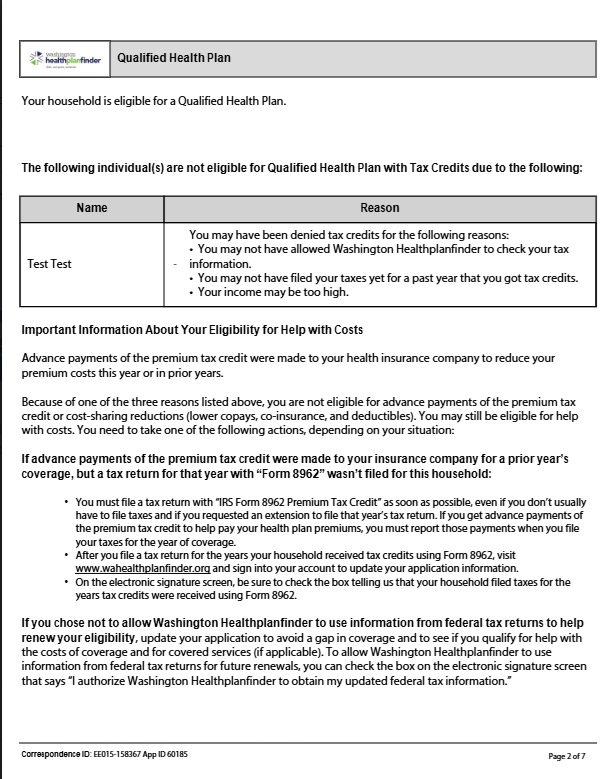

Some reasons you could lose the Advanced Premium Tax Credits because:

- You did not file taxes and reconcile tax credits from previous years.

- Did not consent on application for the Washington Healthplanfinder to request updated tax information.

- Customers who are married filing single instead of jointly on their tax return.

If you lose the Advanced Premium Tax Credits then suddenly what you are required to pay for health insurance can increase!

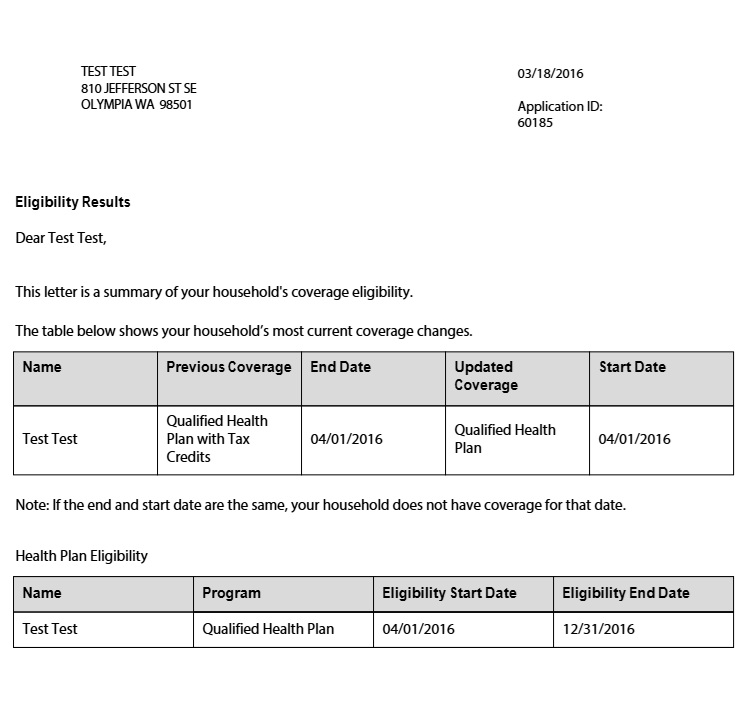

You could receive a letter you don’t understand otherwise known as the scary letter that looks like this:

If you get a scary letter an want help then give Suzie or Matt a call at Wenatchee Insurance. We can confirm what the situation is and how to correct it. This is insurance so it does take times to make changes and it is one of the reasons that we recommend filing taxes as early as possible to reduce problems with your advanced premium tax credits.

Open Enrollment for the Washington Healthplanfinder is November 1 through December 15.