Where to get a 1095 form to file taxes?

Tax season is almost here and people start looking for their 1095 form. It runs from January 16th through April 15th of 2026. If you are receiving your healthcare from the Washington Healthplanfinder, you must file your taxes. It is how the Federal Government double checks if you are receiving all of the help that you are qualified for in the form of Advanced Premium Tax Credits that lower the monthly cost of insurance.

If you receive too much APTC then you will have to repay some or all the excess amount when you file your taxes.

If you receive too little APTC then it will increase your tax refund or lower the amount of taxes that you owe.

There are 3 types of 1095 form

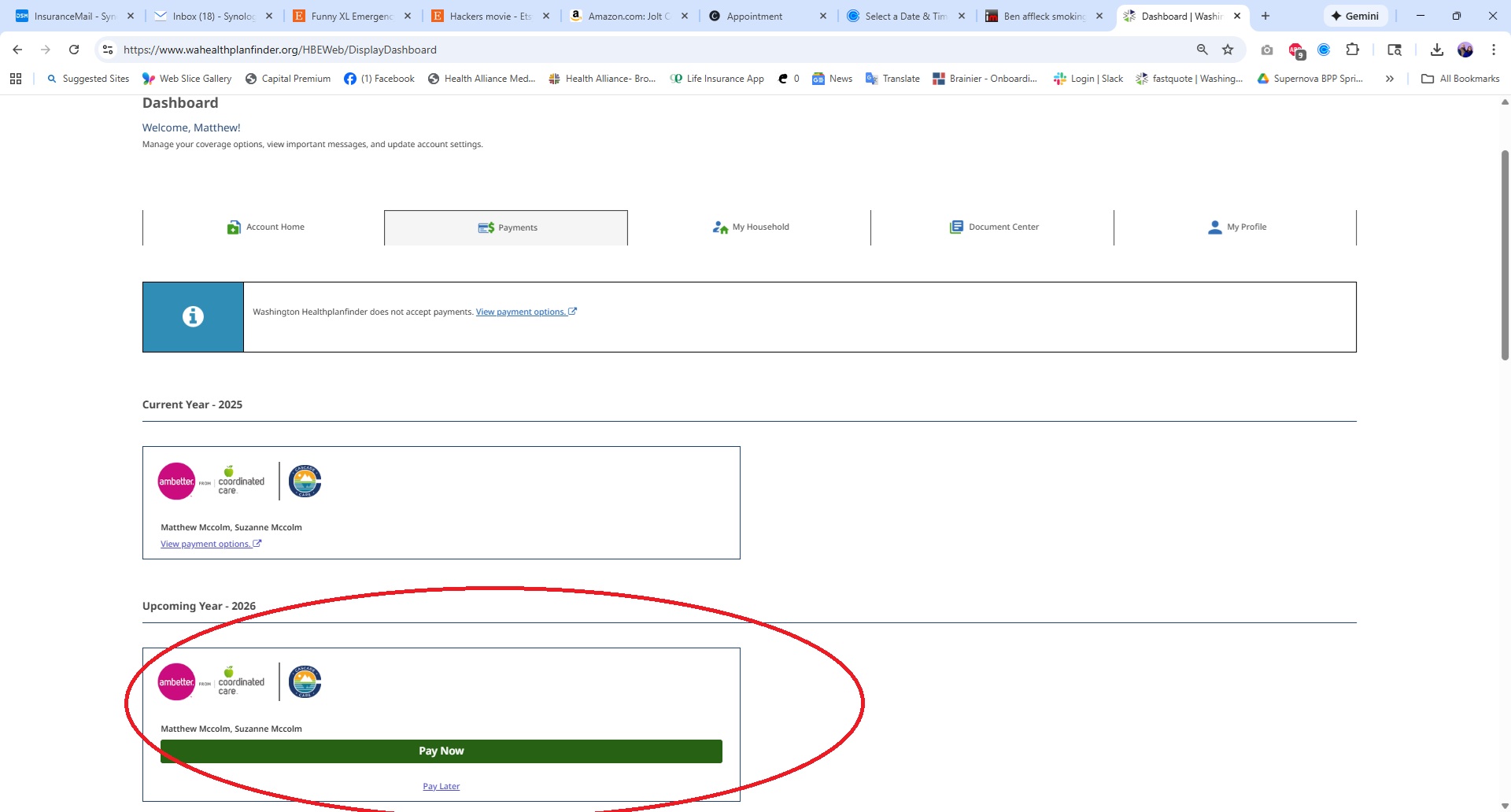

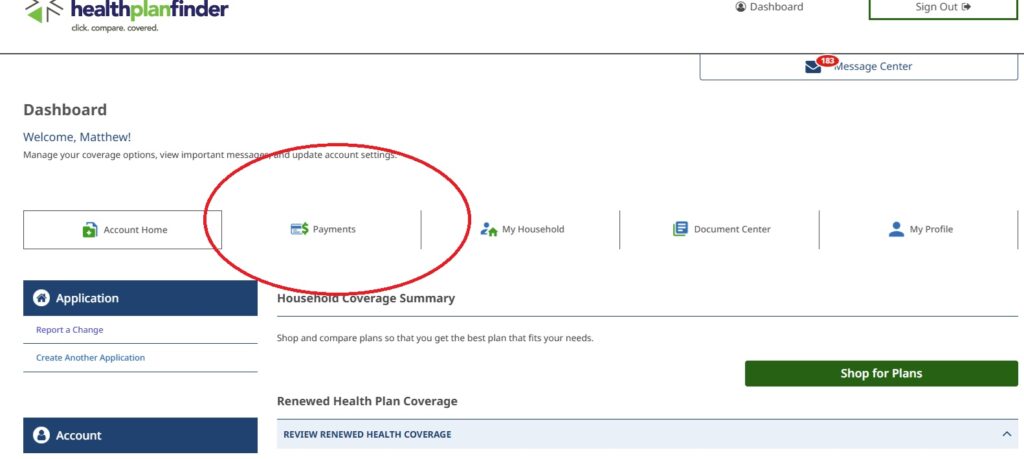

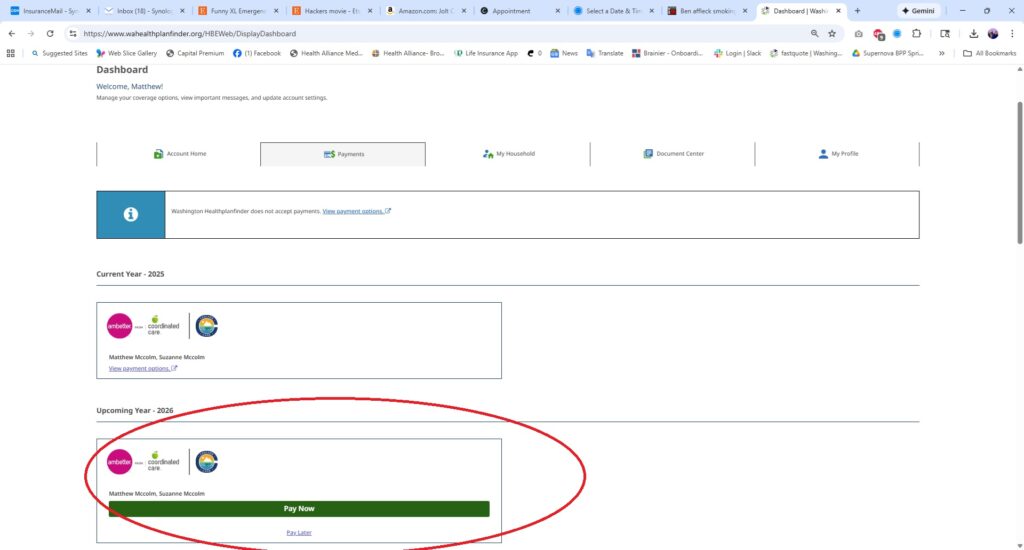

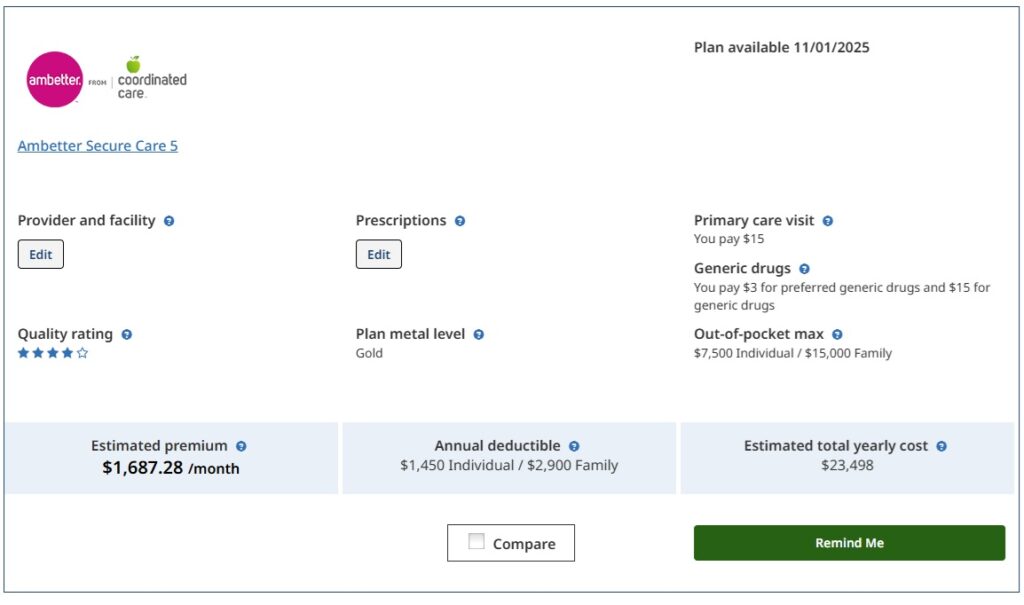

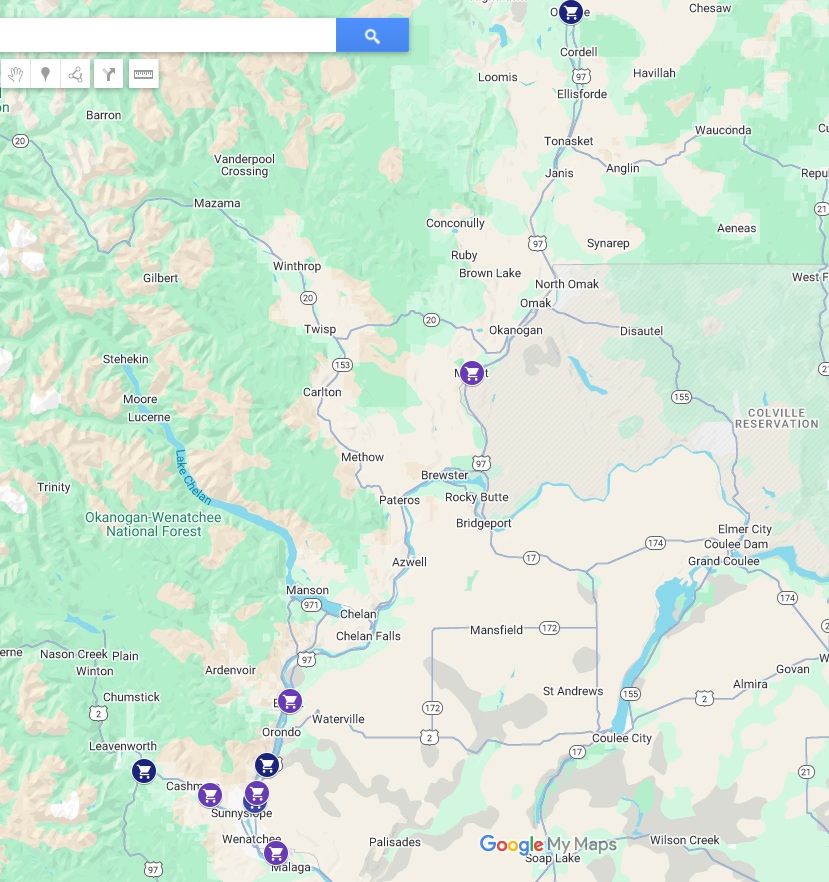

1095-A form is made available usually in the last week of January on the Healthplanfinder and a copy is mailed out. This is for the people who were receiving tax credits that the reduce of the cost of healthcare. In our immediate area in Central Washington if you have Ambetter, Community Health (paid plan) or Lifewise then you will have one of these forms.

If you don’t have a printer and need a copy if you are a client and stop at Wenatchee Insurance on Mission Street, then we can print an additional copy for you.

1095-B form is for the people using Apple Health. It is provided by the Healthcare Authority. It is not mailed out. You can request a form directly from the Healthcare Authority’s page. Form 1095-B is not required when filing taxes.

1095-C form is from employer sponsored health insurance. It is not required for filing taxes.

The 1095-A Form is needed to fill out Form 8962 to reconcile. We saw clients in 2025 that failed to properly file this have problems with their tax credits and recommend filling on time with all forms to prevent the loss of tax credits.

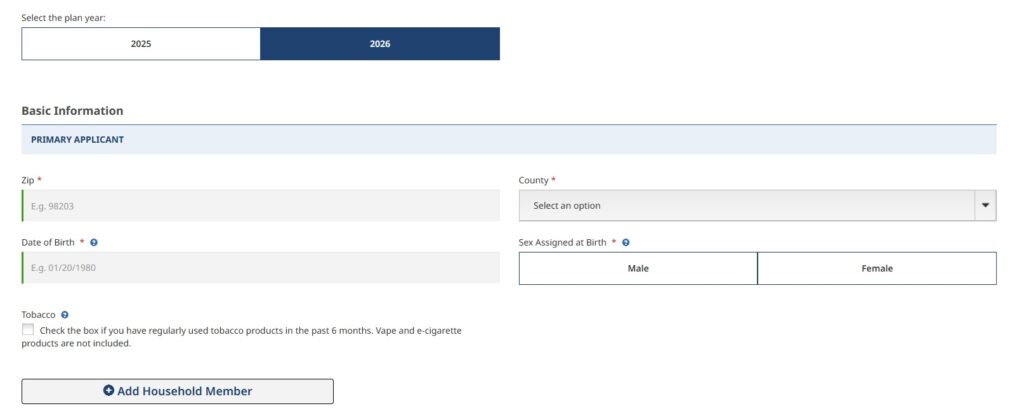

Remember you can adjust your income through the year to better reflect your income so that you don’t have to pay back excess tax credits.

Suzie and Matt have been lending a hand for 13 years in better understanding Health Insurance and if you have questions or just want someone to double check your account it is easy to add a broker of record.