How do I pay for my Health Insurance on the Healthplanfinder?

Suzie & Matt help run the Enrollment Center in Wenatchee and they get a lot of questions. How to make a payment is a big one. This year we are seeing a bunch of new folks as Cascade Care has introduced Immigrants to the Healthplanfinder.

During the open enrollment period the Healthplanfinder allows for an initial payment once your plan has been selected. The open enrollment period runs from November 1st through December 15th.

Since Washington State has it’s exchange the Washington Healthplanfinder they can add additional enrollment periods. For this year, we are going to January 15th for plans starting February 1st.

Some companies will not ship your insurance policy information before they have received payment so it is an important step.

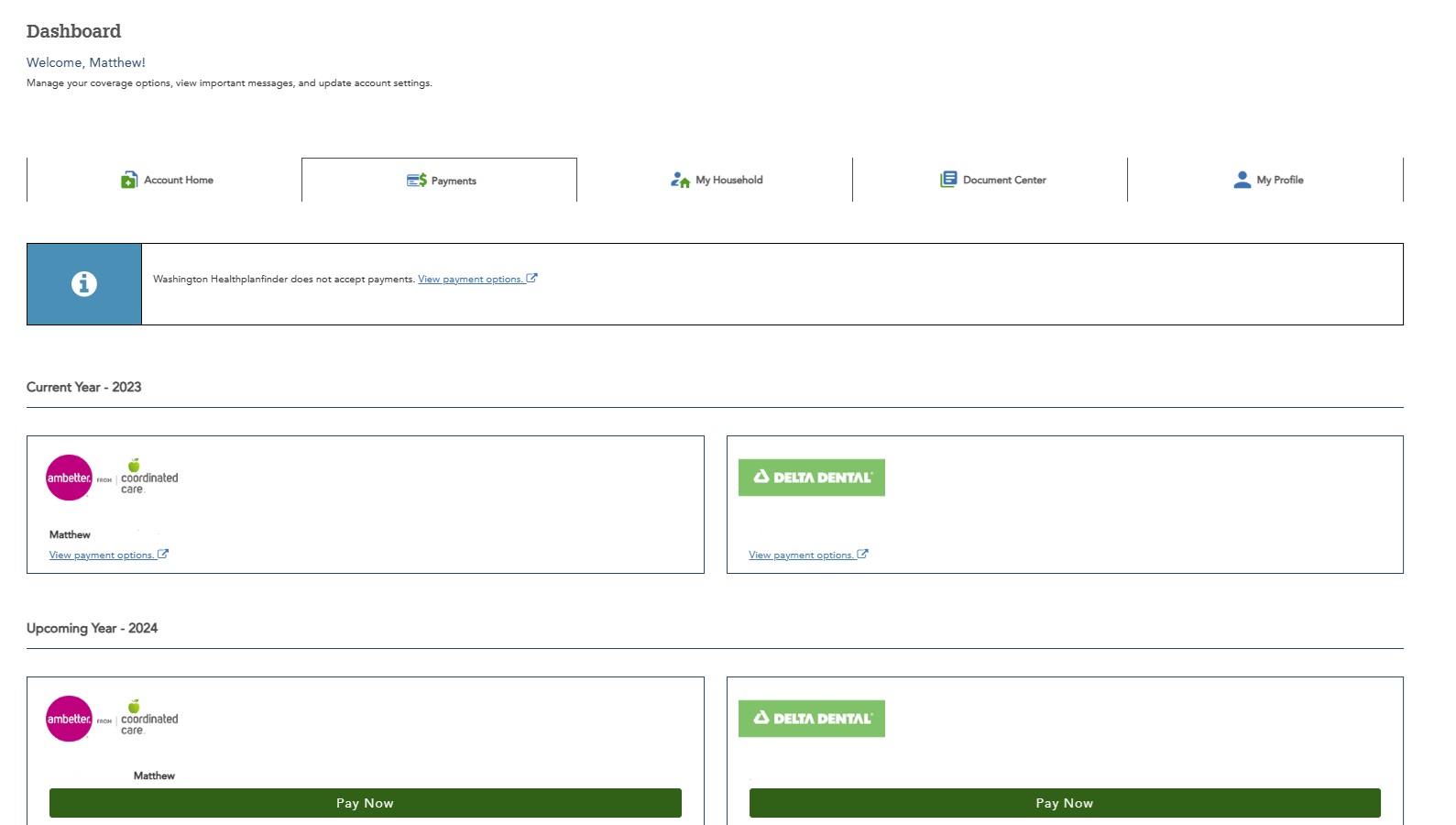

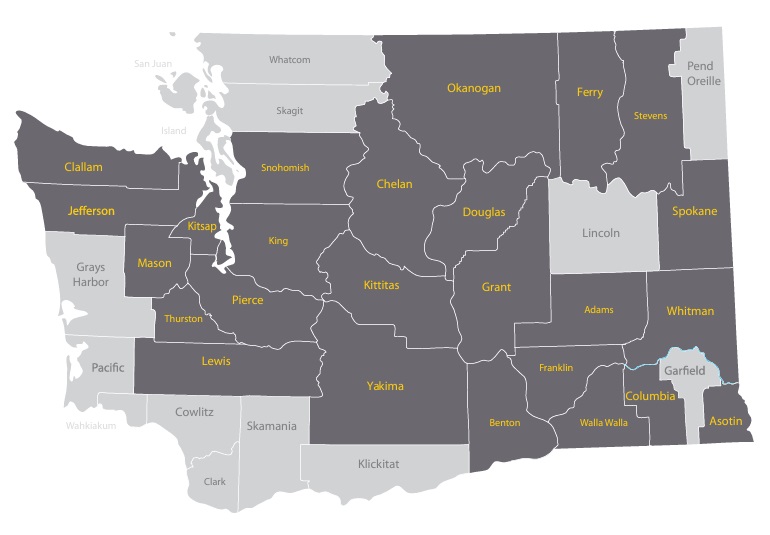

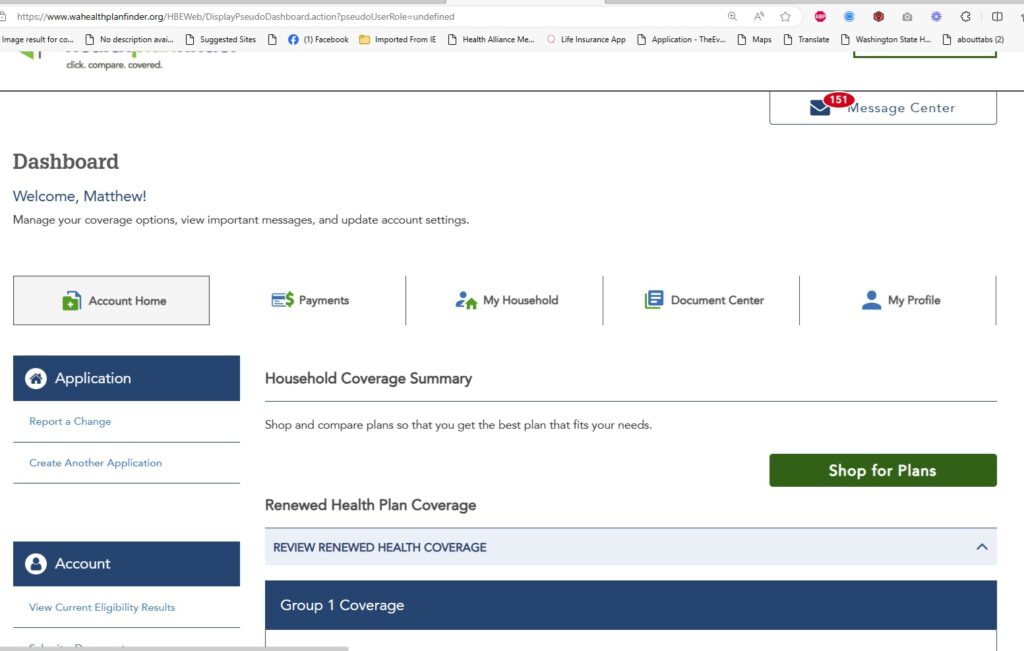

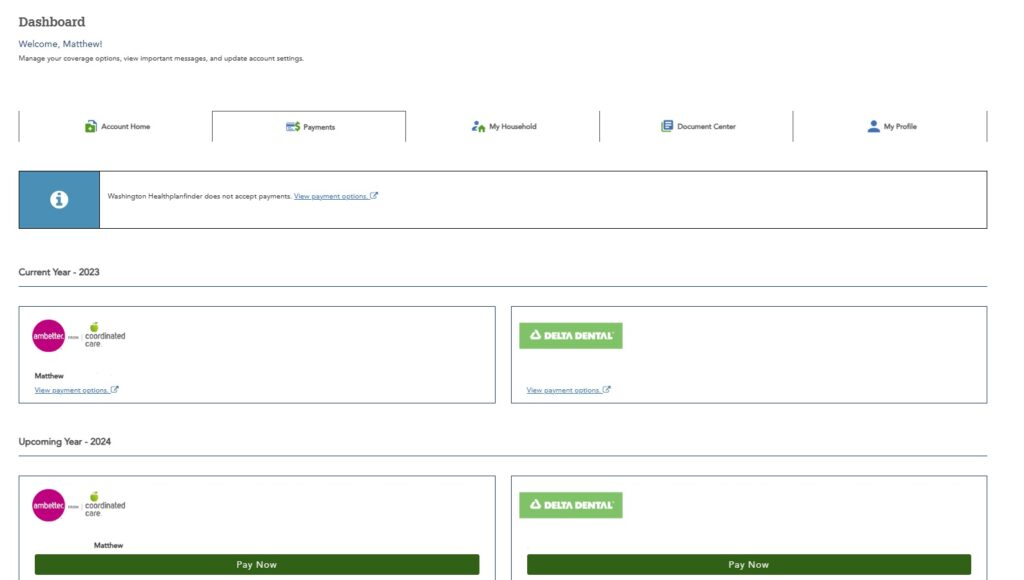

Your main screen will look like this:

Go to the Payment tab, push the Green button, and process the payment. Some companies will allow you to set up the automatic monthly payment here.

Here is the payment tab.

After the enrollment period

You will want to work directly with the insurance companies. Some will allow for automated payments and some insurance companies work well with brokers to allow for payment processing. (Talk to your insurance broker if this is an option).

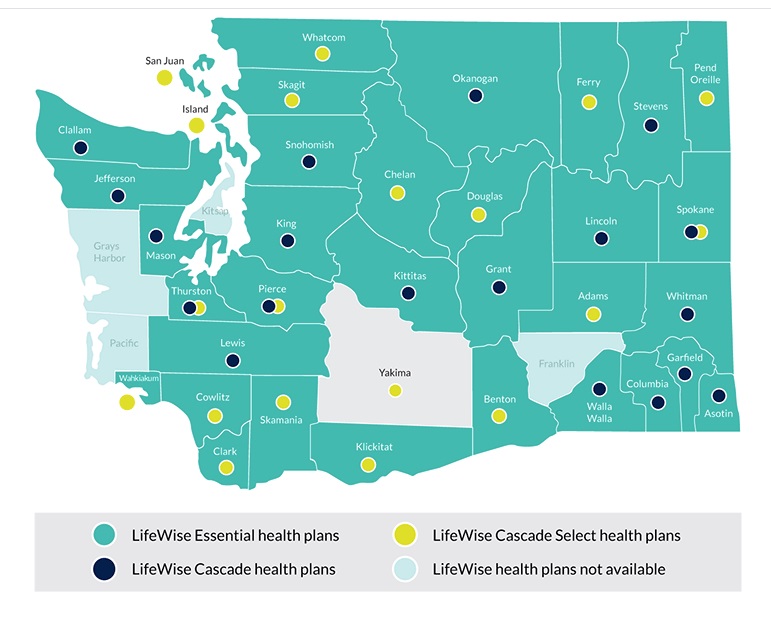

The current list of insurance companies and their payment links:

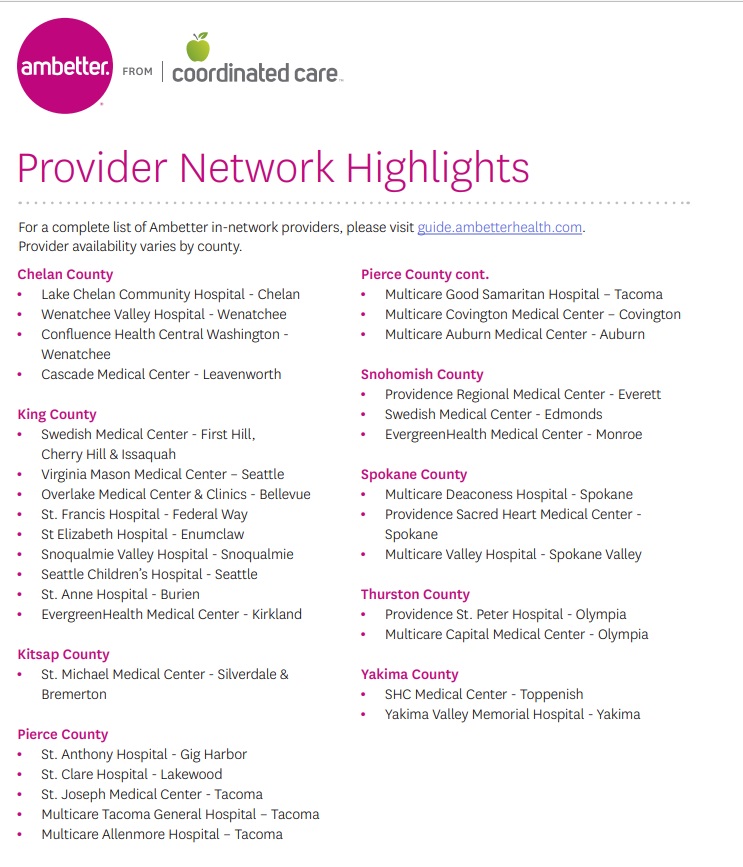

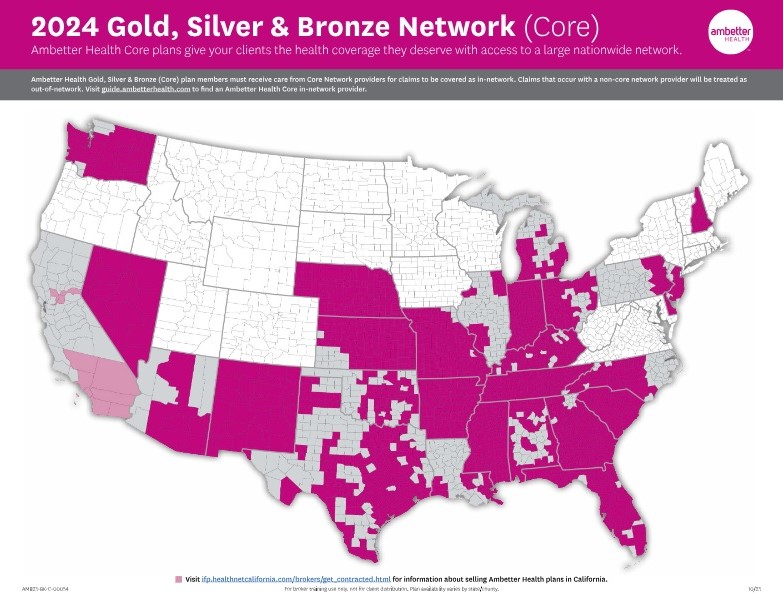

Ambetter from Coordinated Care

If you enrolled using the Washington Healthplanfinder then you can make an immediate payment using the Washington Healthplanfinder during the enrollment period. If you want to use the insurance company’s webpage then it may take a couple of days for the files to transfer. Making a call to the insurance company can speed up the process.

Do not hesitate if you have questions about your insurance plan on the Washington Healthplanfinder to contact Suzie and Matt.